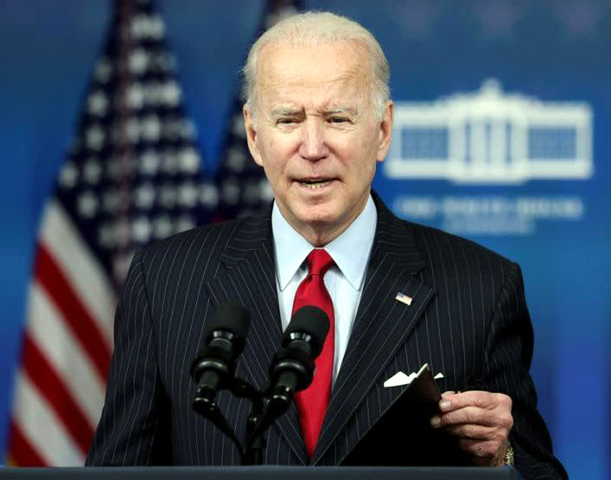

With the US President Joe Biden’s order to release of 50 million barrels from the Strategic Petroleum Reserve (SPR) on Tuesday, oil experts are analyzing whether will this move see a significant drop in gas prices to help bring down energy costs, in coordination with other major energy consuming nations, including India, South Korea, the United Kingdom and of course, the China.

Maintained by the Energy Department, the SPR is an emergency crude oil stored in underground salt caverns at four major oil storage facilities in the Gulf Coast region of the United States, two sites in Texas (Bryan Mound and Big Hill), and two sites in Louisiana (West Hackberry and Bayou Choctaw) in case of natural disasters, national security issues and other events.

According to the OPEC sources, US has roughly 605 million barrels of sweet and sour petroleum in the reserve.

Venezuela has the largest amount of oil reserves in the world with 300.9 billion barrels. Saudi Arabia has the second-largest amount of oil reserves in the world with 266.5 billion barrels.

Emergency crude oil is stored at the Strategic Petroleum Reserve (SPR) As per the report of the US Department of Energy, Of the 50 million barrels set to be released, 32 million barrels will be released in the next few months and will return to the reserve in the years ahead. While, another 18 million barrels will be part of a sale of oil that Congress had previously authorized.

The White House decision comes after weeks of diplomatic negotiations and the release will be taken in parallel with other nations. Japan and South Korea are also participating.

According to Energy Secretary Jennifer Granholm “the oil and gas industry has leases on 23 million acres of public lands on and offshore.”

It is a known fact that the rise in crude gasoline prices has hit the world. Gas prices are at about US $3.40 a gallon, more than 50% higher than their price a year ago, according to the American Automobile Association.

According to the news report, the US government will begin to move barrels into the market in mid to late December. The move is aimed at global energy markets as consumers coping with higher inflation and rising prices. The release will be in crude barrels which will only affect gasoline supply if it prompts refineries to produce more.

Prices have been up and down all month, and were up less than 1%. The consumer price index soared 6.2% from a year ago the biggest 12-month jump since 1990.

Biden has scrambled to reshape much of his economic agenda around the issue of inflation, saying that his recently passed $1 trillion infrastructure package will reduce price pressures by making it more efficient and cheaper to transport goods.

The Biden administration has argued that the reserve is the right tool to help ease the supply problem. Americans used an average of 20.7 million barrels a day during September, according to the Energy Information Administration. That means that the release nearly equals about two-and-a-half days of additional supply.

It is also believed that “Between Thanksgiving, and Groundhog Day, it could be seen gasoline prices drop because demand has dropped to about 2 million barrels a day.

“As we come out of an unprecedented global economic shutdown, oil supply has not kept up with demand, forcing working families and businesses to pay the price,” Energy Secretary Jennifer Granholm said in a statement.

Though there are multiple market dynamics at play as fossil fuel prices are higher around the world several factors are already in play that may drive prices down, Biden’s efforts to minimize prices down could be one of them.

(FROM NEW YORK)